Moving Average Indicator is also one of the most applied indicators in 2020.

Based on study conducted in 2019 and 2020, this indicator is amongst the top 10 indicators, technical analysts in financial markets are using.

One of the reasons that most technical analysts use the Moving Average Indicator Is that this functional indicator is pretty simple to use.

You should note that Moving Average Indicator is a trend showing indicator.

How to Apply Moving Average indicator

One of the main and most basic uses of the Moving Average indicator is to detect trends. Using the indicator, you can spot where the trend starts, where it ends and where the trend reverses, according to your own analysis.

Other applications of the Moving Average indicator include issuance of buy or sell signals.

This indicator serves as a basic indicator when writing formula for other indicators such as Bollinger Bands. it plays a key role.

Structure of Moving Average Indicator

The Moving average indicator or simply MA divides the sum of the last prices to the sum of closed ones and draws a line.

For example, for the average of 7, it adds the opening prices and closing prices in the last 7 periods and Divide the result number by 7 and displays it on the chart.

Now in the next periods, it acts in the same way and finds the moving average and draws it on the chart.

Choosing the timeframe is upon you and can be hourly or daily or weekly and whatever time period you choose, the moving average indicator will work accordingly.

The numbers that are calculated and obtained in the periods are connected to each other on the chart by a line.

We show the moving average obtained with the Moving Average for 60.

Moving Origin indicator moving average

The smaller the number set for the period, more sensitive the averaging will be and hence more it will be volatile. In this case, the number obtained will be closer to the prices.

The larger the number set for the period, the less sensitive the averaging will be. Hence in this case, farther it will be to the current price.

It should be noted that: neither too small periods nor too large ones will be useful. Try to adjust the periods according to your own strategy.

Getting signal with MA indicator

simply, using the moving average indicator When the price is below the moving average, this is sell signal and when the price is above the moving average, this is buy signal.

Of course, it should be noted that you cannot enter the market solely based on the signal of MA.

In fact, we tend to take the trends in such a way that naturally whenever prices are above the moving average, we may be in an uptrend and vice versa, when prices are below the moving average, we may be in a downtrend.

The lower the number used for the period of the MA indicator or the moving average indicator, the more fluctuations for the price and the indicator will touch the chart more.

At this time, it is more probable to receive errors. This should be taken into account.

On the other hand, the larger the period, the less fluctuations will be recorded by the moving average indicator and as a result, fewer signals are recorded and it is more probable that we miss good opportunities for entering the market. so be absolutely careful in choosing the time period.

However, there is a simple solution for this problem, and that is to use two or more moving average indicators at the same time.

Using Multiple Moving Average Indicators

You can filter the signals by two or more MA indicators.

Take a look at the image below:

Use Multiple Moving Average Indicators

Use of multiple moving average MA indicators

In the image above, we used two moving averages of 60 and 30.

Whenever the moving average of 30 crosses the moving average of 60, you can enter the market and start to trade based on the direction the crossover that has taken place. However, this will not be the only factor for entering into a trade.

You may want to use three MA indicators with three different periods and it is still no problem with that.

Take a look at the image below:

Use of 3 moving average MA indicators

In the chart above, in addition to the two moving averages 30 and 60, we also added a moving average of 90, which can be used according to the formula mentioned above.

You can create different strategies with the Moving Average Indicator and you can even filter your own strategies.

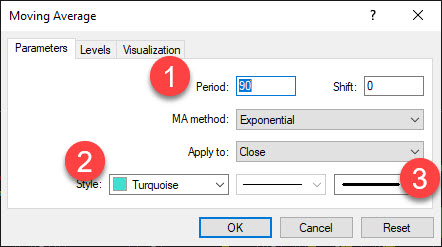

Note: As you can see in the image, the color of each MA indicator can be changed in the settings.

Moving Origin indicator moving average

⦁ In this section you can enter the time interval for averaging. ⦁ Change the color of the line drawn on the chart. ⦁ Adjust the size of the line and the shape.

How to determine support and resistance with moving average indicator?

MA Indicator is one of the most practical indicators in determining Support and resistance levels in technical analysis and is a practical tool in this regard.

The method of determining support and resistance is as follows: we set the line drawn by the MA indicator support levels in uptrends and we consider it the resistance levels in downtrends.

In other words, by passing the price through these lines, we can say that the support or resistance level on the chart has been broken.

In this case, when the support or resistance is broken, we can say that the support becomes a resistance after being broken or the resistance becomes a support level after being broken.

Also, as we said, we can draw several MA indicators on the chart. It should be noted that we can draw several supports or resistances in the chart.

Tips:

⦁ Never enter into the market only based on the Moving Average Indicator. ⦁ This indicator is a confirming indicator, make sure to pay attention to this point. (Full explanation about corrective or confirming indicators will be given to you soon). ⦁ To determine the period, make sure to act according to your personal strategy and your desired time frame and then adjust the indicator accordingly.